Why Small Businesses Need to Understand Pension Auto-Enrolment

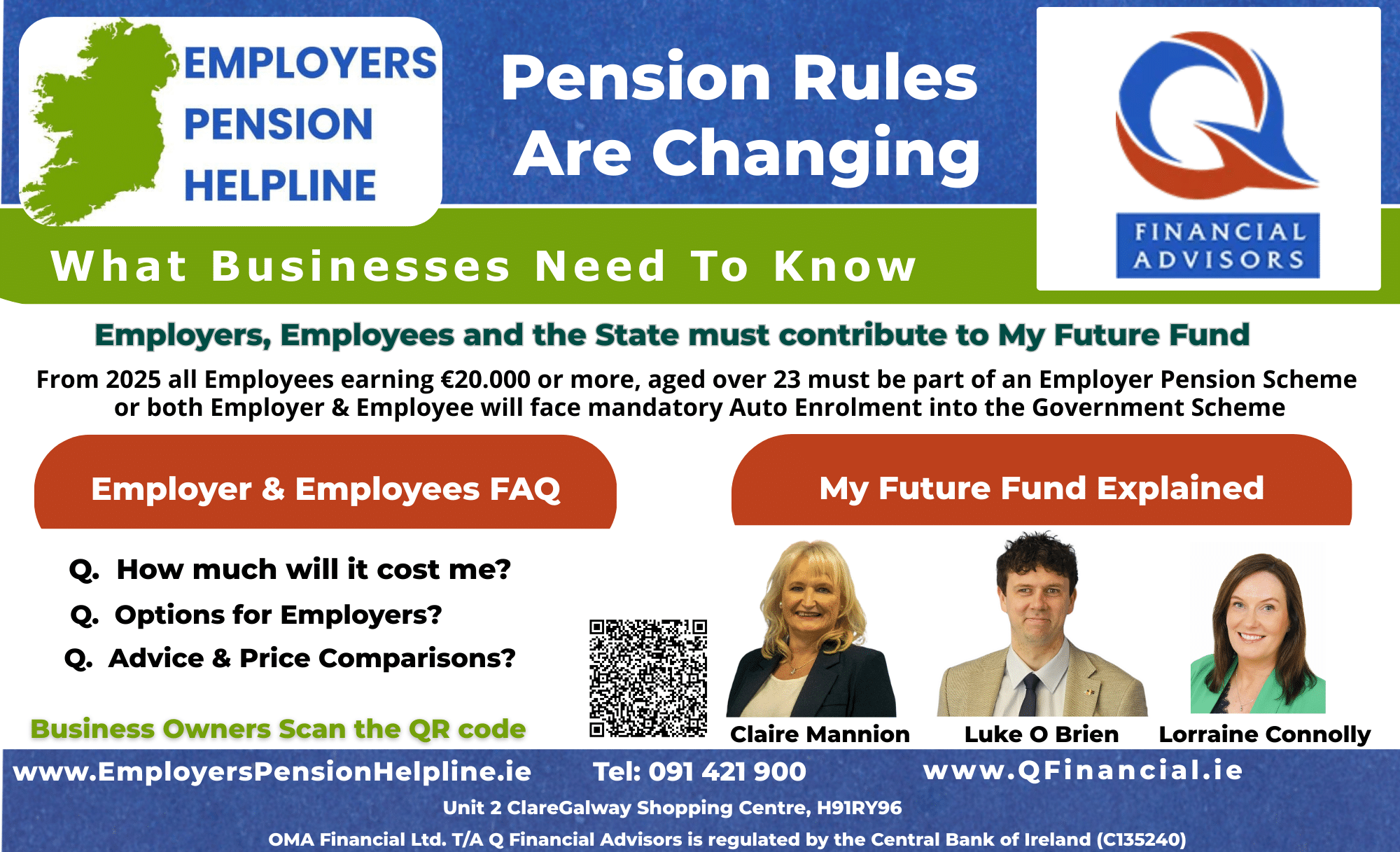

At Q Financial, we understand the challenges small businesses face when navigating Ireland’s new Pension Auto-Enrolment system. To support employers, we established EmployersPensionHelpline.ie — a dedicated service providing free guidance, expert insights, and practical solutions to make pension planning straightforward and tax-efficient.

📞 Book a free consultation today with EmployersPensionHelpline.ie

NAERSA Appointments Announced

Minister for Social Protection Dara Calleary has announced key appointments to the National Automatic Enrolment Retirement Savings Authority (NAERSA), which will implement Pension Auto-Enrolment in Ireland starting January 2026.

Former National Lottery chief, Dermot Griffin, has been named the first Chief Executive of NAERSA. His leadership will guide the rollout of Ireland’s new auto-enrolment system for pensions.

Meet the NAERSA Board Members

The Government has appointed six board members:

-

Professor Alan Barrett – Research professor and former director at the Economic and Social Research Institute

-

Tony Donohoe – Chair of the Expert Group on Future Skills Needs

-

Patricia King – Former General Secretary of the Irish Congress of Trade Unions

-

Brian Murphy – Chartered accountant and former Chief of Staff to the Taoiseach

-

Dr Orlaigh Quinn – Former Secretary General of the Department of Enterprise, Trade and Employment

-

Mary Walsh – Former partner at PwC, former non-executive director of the Central Bank, NTMA, and Pensions Board

Pension Auto-Enrolment Ireland: My Future Fund

The first contributions under the retirement savings system, called “My Future Fund,” will become mandatory for all businesses by January 1st, 2026.

Despite media campaigns on TV, radio, and press, many small businesses in transport, retail, restaurant, hardware, and construction sectors have not yet fully engaged with the scheme.

“The media campaign has been underway for more than a month. While the public is developing an interest in pension savings, small businesses are yet to engage,” says Lorraine Connolly, Director at EmployersPensionHelpline.ie.

Small Business Engagement Concerns

Many small businesses lack education about the system and how it will affect them. Tens of thousands of employers will be required to make contributions on behalf of employees, but awareness is still limited.

🌟 What Employers Need to Know: Flexible Pension Solutions

A one-size-fits-all government approach may not suit every business. Older employees may prioritize retirement benefits, while other staff may value Life Cover or Income Protection. Private schemes also allow tax relief from day one, unlike the deferred government contribution.

💡 Solutions: Company Master Trusts and PRSAs

For small firms, Company Master Trusts or PRSAs may be a better option than the standard auto-enrolment scheme. Benefits include:

- Tailored contribution rates for each employee

- Flexible investment fund options

- Control over management charges

- Custom employee benefits

This allows employers to match benefits to staff priorities while keeping contributions tax-efficient and flexible.

For more guidance, book a consultation with EmployersPensionHelpline.ie.

Employer Considerations and Review with Staff

The EmployersPensionHelpline.ie reports strong interest from small businesses in Transport, Motor, Restaurant, Retail, Construction, Pharmacy, Medical, and Engineering sectors.

- Seek professional advice before reviewing pension arrangements with staff.

- Pension Auto-Enrolment isn’t the only option — explore bespoke arrangements tailored to your business.

- Tailor contributions to staff affordability, roles, and career stage.

- Maximize tax relief by choosing private schemes where possible.

“Pensions are important to all staff today. Deliver a flexible scheme that enhances your reputation and aligns staff aspirations with your company’s plans,” says Lorraine Connolly.

📞 Get Expert Help from EmployersPensionHelpline.ie

Q Financial set up EmployersPensionHelpline.ie to help small business employers navigate Pension Auto-Enrolment in Ireland. Book a free consultation today to review your options, tailor contributions, and maximize tax efficiency.

More info: QFinancial.ie/Pensions