As 2025 approaches, Ireland’s pension landscape is undergoing significant changes that will impact most employers and employees and how they manage their retirement savings.

These updates were introduced in the Finance Bill 2024, including new limits on employer contributions.

Whether you’re an employer, employee, or company director, you need to understand these changes. It’s crucial for you to make the most of the new opportunities and avoid potential pitfalls.

We have put together this article for you, breaking down the key pension changes you need to watch out for in 2025:

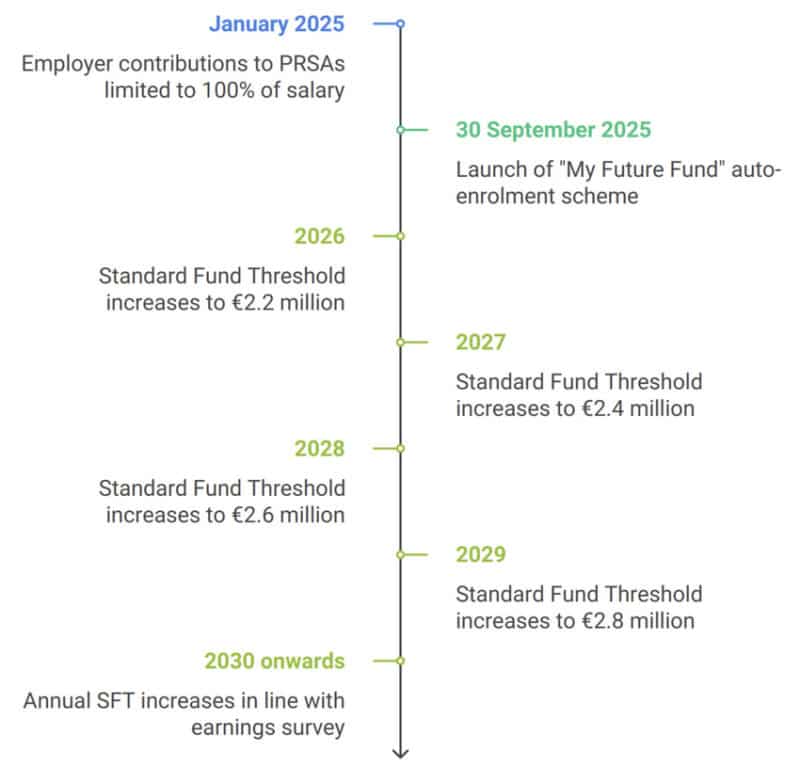

- Employer Contributions to PRSAs Limited to 100% of Salary

From January 2025, employers will be restricted to contributing a maximum of 100% of an employee’s or director’s salary to a Personal Retirement Savings Account (PRSA).

For instance:

- If an employee earns €50,000, the employer can contribute up to €50,000 to their PRSA.

- Any contributions exceeding this limit will be treated as a Benefit in Kind (BIK), meaning the excess amount will be taxed as part of the employee’s income.

This change is particularly relevant for high earners and company directors, so it’s worth reviewing your PRSA contributions now to ensure compliance in 2025.

2. Gradual Increase in the Standard Fund Threshold (SFT)

The Standard Fund Threshold (SFT), which caps the lifetime amount of tax-relieved pension savings, is set to increase gradually over the coming years. Here’s the updated schedule:

- 2026: €2.2 million

- 2027: €2.4 million

- 2028: €2.6 million

- 2029: €2.8 million

- From 2030 onwards, the SFT will increase annually in line with the Earnings, Hours and Employment Cost Survey.

This phased increase provides more flexibility for those nearing or exceeding the current threshold, but it’s vital to monitor your pension pot to avoid breaching the SFT and incurring additional taxes.

3. Introduction of Auto-Enrolment: Now Named “My Future Fund”

The long-awaited Auto-Enrolment Retirement Savings Scheme, branded as “My Future Fund”, will launch on 30 September 2025. This is a delay of the original launch date for auto enrolment which was previously set to the start of January 2025.

Key details include:

- Eligibility: Employees aged 23-60 who are earning €20,000 or more per year, who are not already enrolled in a pension plan will be automatically enrolled.

- Contributions: The scheme is designed to make saving for retirement easier, with contributions shared between employees, employers, and the government.

Auto-enrolment aims to address the pension savings gap in Ireland, but it also means employers need to prepare for additional responsibilities. If you’re unsure how auto-enrolment will affect your business, now is the time to seek advice, Q Financial Advisors are experts in pensions and redundancies, offering free consultations. Talk to us.

Read this blog on: 7 Tips to Maximise Benefits Ireland 2024 Pension Auto Enrolment Scheme

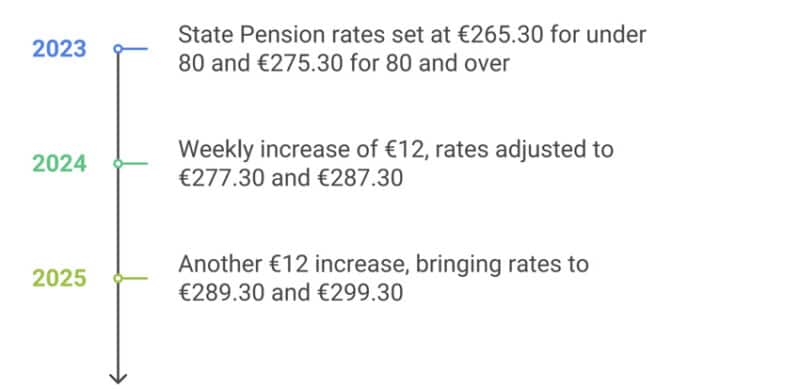

4. Increase in Social Welfare Payments

As part of the budget changes, most weekly social welfare payments will rise from January 2025.

This includes increases to the State Pension (Contributory):

This table clearly shows the year-on-year increases in the weekly State Pension (Contributory) rates. The consistent €12 weekly increase each year. These increases reflect the government’s efforts to support retirees amid rising living costs, but they also underline the importance of personal pension planning to complement state benefits.

5. Pension Lump Sum Taxation: Thresholds Remain Unchanged

The taxation of pension lump sums remains largely the same:

- The tax-free portion of a pension lump sum remains capped at €200,000.

- The 40% tax rate threshold continues to apply to amounts exceeding €500,000.

Despite the SFT increases, these limits will not change, meaning individuals planning large lump sum withdrawals should carefully assess their tax liabilities.

Read this related blog on: Pension Tax Free Lump Sum 101: Understanding Your Retirement Payout Options in Ireland

What Do These Changes Mean for You?

These updates reflect Ireland’s evolving demographic landscape. These changes are looking to encourage people to improve their retirement savings while balancing taxation policies.

These changes also introduce complexities, particularly for high earners, company directors, and employers navigating new contribution rules and auto-enrolment requirements.

If you’re wondering how these changes will affect your pension planning, now is the time to act.

Talk with Q Financial Advisors to get a clear picture of your pension options. Q Financial Advisors offer their expertise on Irish pensions, giving invaluable advice and support to thousands of Irish employees.

Whether it’s understanding how these rules impact your retirement goals or ensuring compliance as an employer, our guidance can make all the difference. Talk to our team for a free consultation today.