The introduction of the Automatic Enrolment (AE) pension scheme, in Ireland, is set to begin in January 2025. Marking a significant shift in how pensions are managed for employees.

As an employer, navigating this new landscape can be a challenge, but avoiding common mistakes can help to give your business a smooth transition that follows the new Irish regulations.

Here are some key tips to help you avoid pitfalls, and make the best pension decisions going into 2025.

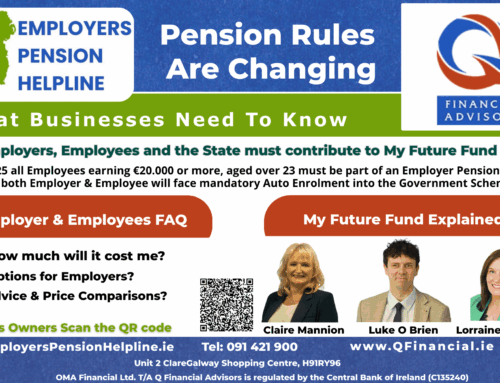

Talk to Expert Pension Advisors in Ireland, free consultation call. With Q Financial Advisors, you get access to a regulated financial advisor. They will examine the costs and charges associated with your pension and do a full comparative analysis among all regulated pension providers available. Talk to Q Financial today to find out your best pension options, getting ahead of auto enrolment.

Understand the Pension Auto Enrolment System

Eligibility and Contributions –

The Auto Enrolment pension system will automatically enrol employees aged between 23 and 60 who earn more than €20,000 per year, and who are not already part of a pension scheme.

Initial contributions will start at 1.5% of gross income from both employees and employers. This contribution increases gradually over ten years to a maximum of 6%. The government will also contribute to the pension fund, making this a great savings option.

Common Mistakes to Avoid

1. Ignoring the Auto Enrolment Requirements

One of the biggest mistakes employers can make is ignoring the Auto Enrolment (AE) requirements. The Auto Enrolment pension scheme is mandatory for eligible employees, and failing to comply can result in penalties and potential prosecution. Ensure that your payroll systems are updated and capable of handling the new contributions and reporting requirements.

2. Delaying Implementation

With the Auto Enrolment (AE) scheme set to launch in Ireland in January 2025, employers have a limited timeframe to prepare. Delaying the implementation can lead to rushed decisions and errors. Start planning now to ensure that your systems and processes are ready well before the deadline.

3. Not Communicating with Employees

Effective communication with your employees about the Auto Enrolment scheme is crucial. Employees need to understand how the system works, their contribution levels, and the benefits they will receive.

Clear communication can prevent confusion and ensure that employees are well-informed about their retirement savings options.

4. Overlooking Existing Pension Schemes

If your company already has a pension scheme, you need to understand how it will integrate with the Auto Enrollment scheme. Some employees may end up in a “dual scheme” situation, contributing to both their existing pension scheme and to the new Auto Enrolment pension scheme. This can create a headache and a disconnect with your company and your employees, which can cause potential employee issues. Evaluate whether it makes sense to transition entirely to the Auto Enrollment scheme or maintain both schemes.

Talk to Expert Pension Advisors in Ireland, free consultation call. With Q Financial Advisors, you get access to a regulated financial advisor. They will examine the costs and charges associated with your pension and do a full comparative analysis among all regulated pension providers available. Talk to Q Financial today to find out your best pension options, getting ahead of auto enrolment.

5. Failing to Review Contribution Levels

As the Auto Enrolment scheme phases in, contribution levels will increase. Employers need to plan for these incremental increases and ensure that they are budgeted for. Regularly reviewing and adjusting contribution levels can help manage the financial impact on both the company and the employees.

Best Practices for Employers

1. Start Early

Begin preparations as soon as possible. This includes updating payroll systems, training HR staff, and communicating with employees about the changes. Early preparation can help avoid last-minute issues and ensure a smooth transition.

2. Use Technology

Leverage payroll software and other technological tools to manage contributions and reporting efficiently. The Auto Enrollment scheme is designed to be as straightforward as possible, but having the right tools in place can minimise administrative headaches.

3. Seek Professional Advice

Consult with independent financial advisors or pension experts to understand the implications of the AE scheme for your business. They can provide valuable insights and help you navigate the complexities of the new regulations.

4. Monitor Compliance

Regularly review your compliance with Auto Enrollment requirements. This includes ensuring that all eligible employees are enrolled, contributions are made correctly, and any changes in employee status are promptly updated. Staying on top of compliance can prevent costly penalties and ensure that your company meets its obligations.

5. Educate Your Employees

Provide ongoing education and resources to help your employees understand the Auto Enrollment scheme and the importance of retirement savings. This can include workshops, informational materials, and one-on-one consultations with financial advisors.

Conclusion

The introduction of the Auto Enrollment scheme in Ireland presents both challenges and opportunities for employers. By avoiding common mistakes and implementing best practices, you can ensure a smooth transition and support your employees in building a secure retirement. Start preparing now to take full advantage of the benefits that the Auto Enrollment scheme offers.