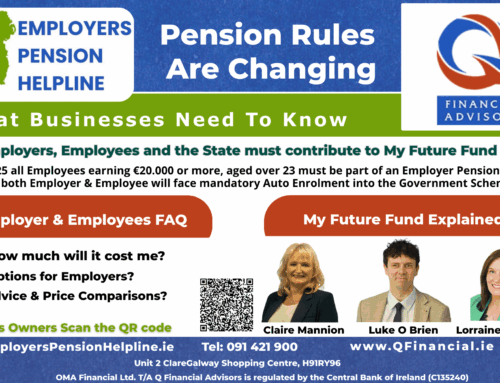

The introduction of the pension auto enrolment scheme in Ireland in 2024 is a major change in retirement savings for most workers across Ireland.

Note: You will be automatically enrolled in the new pension scheme in 2024 if you are an employee and:

- You are aged between 23 and 60

- You are not currently part of a pension plan

- You earn €20,000 or more per year

Starting a pension is easy with the right partner. With QFinancial Advisors, you will get access to a regulated financial advisor. They will examine the costs and charges associated with your pension and do a full comparative analysis among all regulated pension providers available. Start Your Pension With A Few Clicks – or – Talk to QFinancial today to find out your best pension options, getting ahead of auto enrolment.

**All pension consultations are 100% free

If you are asking yourself How do I find all my pensions? QFinancial is the best place to find out the answer.

The guide below gives you 7 insights and practical tips to help you navigate and maximise the benefits from this upcoming pensions initiative.

1. Start Contributing Early

The earlier you start saving through the pension auto enrolment scheme, the more time your money has to grow through compounding. Even if the initial contributions are small, the long-term benefits can be substantial.

Your employer and the government must also add to your savings.

2. Understand Your Contribution Levels

Familiarize yourself with the phased contribution levels set by the scheme. Starting at 1.5% of your gross salary for both you and your employer in the first three years, and escalating every few years until it reaches 6%, being aware of these levels will help you budget accordingly and understand how your pension is projected to grow.

The table below sets out the rates you, your employer, and the Government will pay:

Calculate auto enrolment pension contributions

| Auto-Enrolment Scheme Year | Employee Contribution Rate | Employer to Contribute | Government to Pay | |

|---|---|---|---|---|

| 1 to 3 | 1.5% | 1.5% | 0.5% | |

| 4 to 6 | 3% | 3% | 1% | |

| 7 to 9 | 4.5% | 4.5% | 1.5% | |

| 10 and after | 6% | 6% | 2% |

Pension Auto Enrolment Example

See the below table example of calculating auto enrolment pension contributions.

| Year of the auto-enrolment scheme | Employee pays | Employer pays | Government pays | Total payments per year |

| 1 to 3 | €300 | €300 | €100 | €700 |

| 4 to 6 | €600 | €600 | €200 | €1,400 |

| 7 to 9 | €900 | €900 | €300 | €2,100 |

| 10 and after | €1,200 | €1,200 | €400 | €2,800 |

The source of the table is from the citizen information website.

Get ahead of Auto-Enrolment. Take 2 minutes to get started. Start Your Pension Today.

3. Take Advantage of Employer and Government Contributions

The pension auto enrolment scheme is structured to maximise your pension through contributions not only from you but also from your employer and the government. For every €3 you contribute, €7 is added to your pension pot (up to a salary cap of €80,000), making the auto enrolment scheme a highly beneficial savings mechanism.

4. Stay Enrolled for Enhanced Benefits

While you have the option to opt-out after six months, staying enrolled allows you to benefit from continuous contributions and compound interest. The scheme includes provisions such as automatic re-enrolment after two years if you opt out, ensuring that you have the opportunity to continue saving should your circumstances change.

5. Review and Compare with Existing Pensions

If you already have a private or occupational pension, compare it with the benefits offered by the pension auto enrolment scheme. For some, it may be beneficial to maintain their current pension; for others, switching to or supplementing with auto enrolment could offer better retirement prospects.

6. Understand the Flexibility of the Scheme

The pension auto enrolment scheme allows for some flexibility in how you manage your contributions. You can opt out after six months and rejoin later, and you can suspend contributions if necessary. This flexibility can be crucial during times of financial uncertainty or changing job circumstances.

7. Plan for the Long Term

Consider how changes in your employment, such as switching jobs or ceasing work, affect your pension under the auto enrolment scheme. Your pension pot follows you from job to job, ensuring that you continue to benefit from past contributions, and remains invested even if you stop making contributions.

Talk to QFinancial Advisors today to have a free consultation to find out your best pension options. Click here — or — Start Your Pension Now.

Additional Insights from the Auto-Enrolment Scheme:

- Legislative Framework: The Automatic Enrolment Retirement Savings System Bill 2024 lays the groundwork for this scheme. Introduced under the supervision of the newly established National Automatic Enrolment Retirement Savings Authority and the Pensions Authority.

- Penalties for Non-Compliance: Guidance for employers. Employers failing to meet their obligations under the scheme face penalties and possible prosecution, which underscores the government’s commitment to ensuring that all eligible workers have a chance to save for retirement.

- Investment and Security: The scheme operates a default lifecycle investment strategy to balance risk and return as you approach retirement. Supervision is provided to ensure safe and regulated investment of your savings.

- Benefits Upon Retirement: When you retire, you can access your savings pot, which can include a lump sum payment among other retirement products that will become available as the system matures.

By understanding these facets of the auto-enrolment scheme and planning strategically, you can significantly enhance your readiness for retirement, ensuring a more secure and prosperous future.