As we say goodbye to 2024 and welcome 2025, it’s crucial for Irish pension savers to stay informed about the latest tax breaks. Capture opportunities and maximise retirement savings.

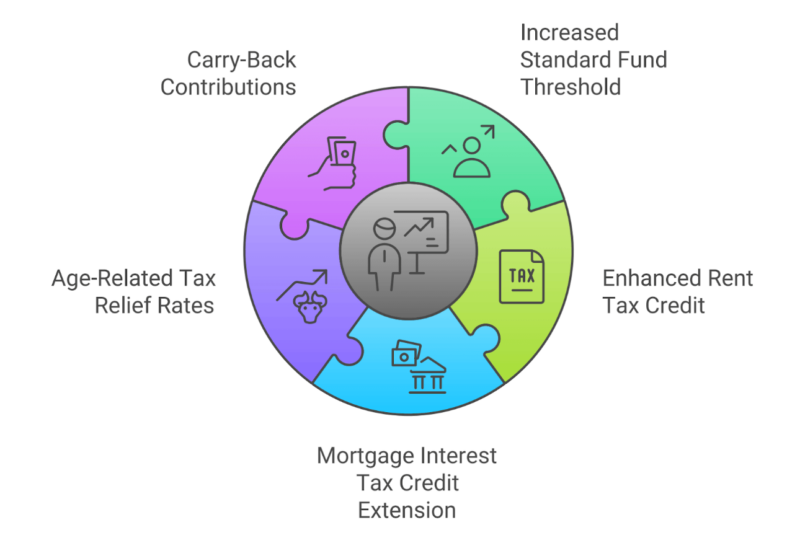

Here are five lesser-known tax breaks that could boost your pension pot in the coming year:

1. Increased Standard Fund Threshold (SFT)

The Standard Fund Threshold is set to increase to €2.2 million in 2026, with further increases planned in subsequent years. While this mainly affects high earners, it’s worth noting as it provides more room for tax-efficient pension growth.

2. Enhanced Rent Tax Credit

The Rent Tax Credit has increased to €1,000 for single people and €2,000 for jointly assessed couples in 2025. This increase, backdated to 2024, can free up more disposable income for pension contributions.

3. Mortgage Interest Tax Credit Extension

With the extension of the Mortgage Interest Tax Credit, homeowners can claim up to €1,250 in tax relief on mortgage interest. This savings opportunity could be redirected towards pension contributions.

4. Age-Related Tax Relief Rates

Don’t forget that your pension contribution limits increase with age. For those aged 60 and over, you can contribute up to 40% of your earnings (subject to a €115,000 earnings cap) and receive tax relief at your highest rate.

Read related blog: Is Unlocking Your Pension Early Worth the Risk? Here’s What You Need to Know

5. Carry-Back Contributions

You can make a pension contribution before October 31, 2025, and backdate it to the 2024 tax year. This allows you to maximise your tax relief for 2024 if you haven’t reached your contribution limit.

Remember, these tax breaks are subject to change and individual circumstances vary. It’s always wise to consult with a financial advisor to ensure you’re making the most of these opportunities while staying compliant with the latest regulations.

Talk with Q Financial Advisors to get a clear picture of your pension options.

Q Financial Advisors offer their expertise on Irish pensions, giving invaluable advice and support to thousands of Irish employees. Learn more.